Since our prior post last week (with data from January 1 – Mar. 17, 2020), more communities around the world have been locked down and more people are working from home. Marketplaces continue to update their policies for marketplace sellers, brands and retailers are adjusting advertising spend, and businesses are jockeying with fulfillment options. We’ve built a COVID-19 resources page to help you keep up with major developments. This blog post is designed to provide an update on Rithum aggregate gross merchandise value (GMV) trends.

First, some important points to understand before digging into the data:

- This data is based on marketplaces GMV aggregated across our entire customer base globally and compares Jan 1 – Mar 22, 2019 against Jan 1 – Mar 22, 2020.

- The data presented below highlights only specific marketplace categories, which are merely a subset of all categories. Because marketplaces have different category structures, the data is presented using categories that have been standardised by Rithum.

- This data is not a proxy for overall e-commerce activity or the performance of any individual business, including Rithum or any individual marketplace.

- The data shown below is based on a year-over-year comparison of trailing 7-day GMV and is expressed as percentage growth, but with actual numbers removed. The Y-axis scale is different on each graph.

- All calculations are done in USD. Global currencies are converted to USD using the conversion rate on the day of the order. These results are not normalised to account for fluctuating exchange rates. Please note that there has been significant volatility in various currencies, such as GBP, which may impact these trends.

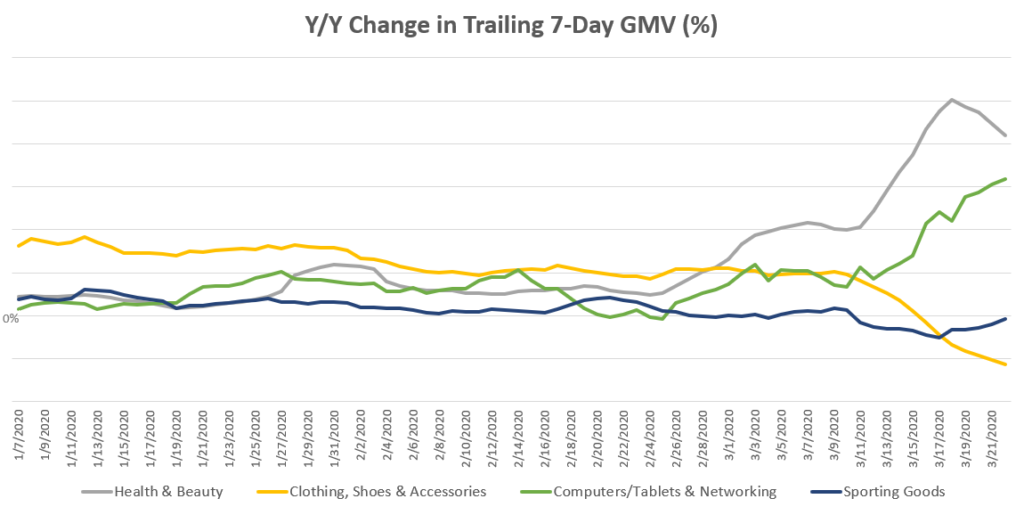

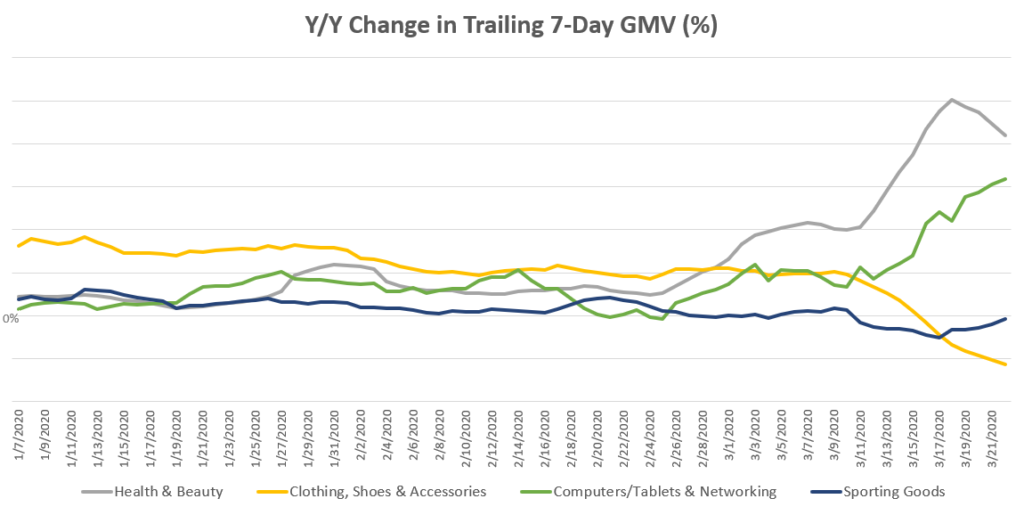

Broad Categories

Looking at the four broad categories we reviewed in the prior post, the health and beauty and computers/networking categories were still the strongest in terms of year-over-year growth. Though still showing strong growth over last year, the pace of growth has slowed. However, computers/networking continued to grow as more and more people found themselves working from home. The declining growth in sporting goods appeared to have turned a corner while the apparel category continued to decline, albeit with a slight hint at bottoming out as the rate of decline decreased.

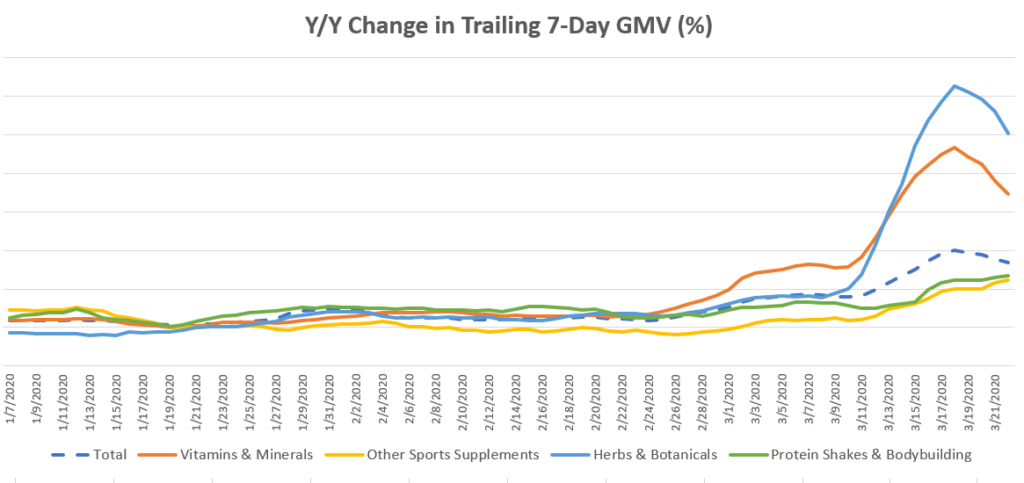

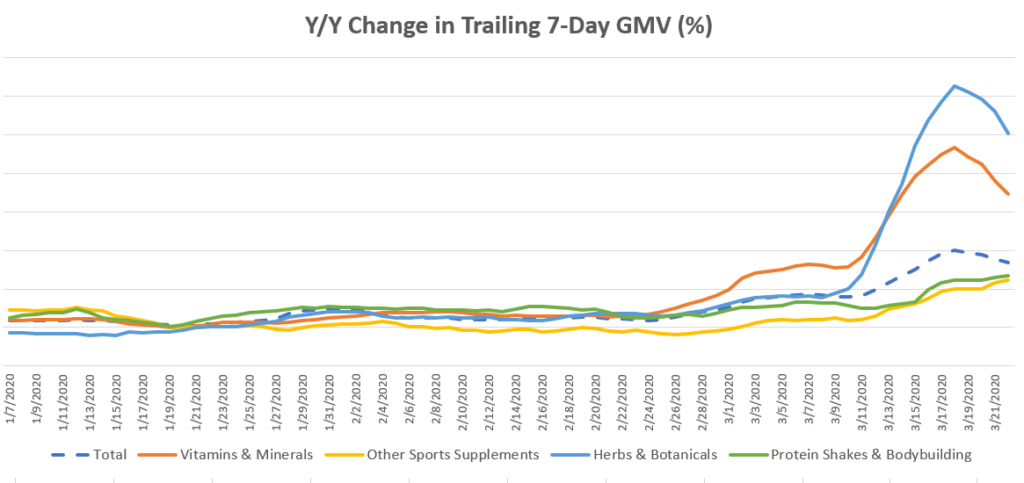

Health and Beauty Category

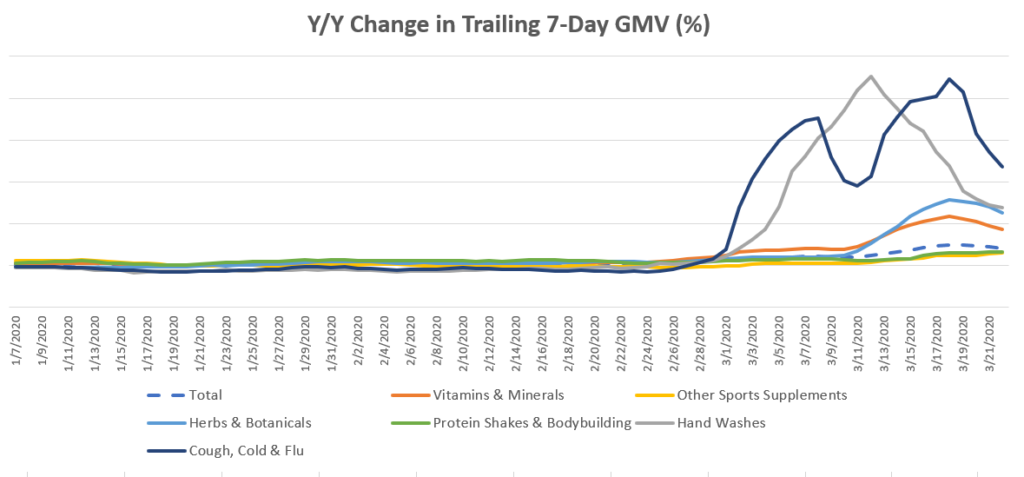

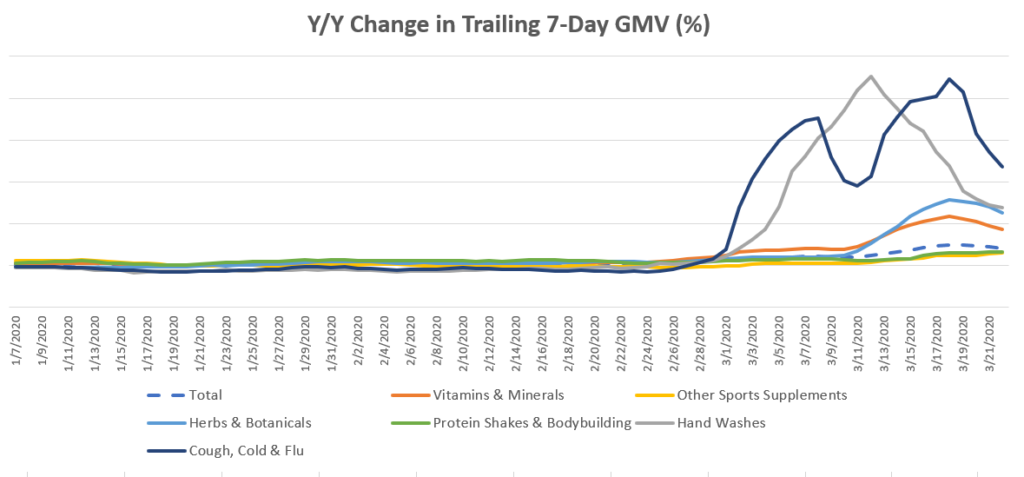

As a reminder, we have more than 300 subcategories in the health and beauty segment. The chart below provides an update on some of the larger subcategories. While the “essentials” (vitamins/minerals and herbs/botanicals) were still growing stronger than the sports-related subcategories (which were also growing), there does appear to be a reversion toward the mean.

The same pattern holds true when looking again at the “hand washes” and “cough, cold, flu” subcategories, which are smaller than the subcategories highlighted above.

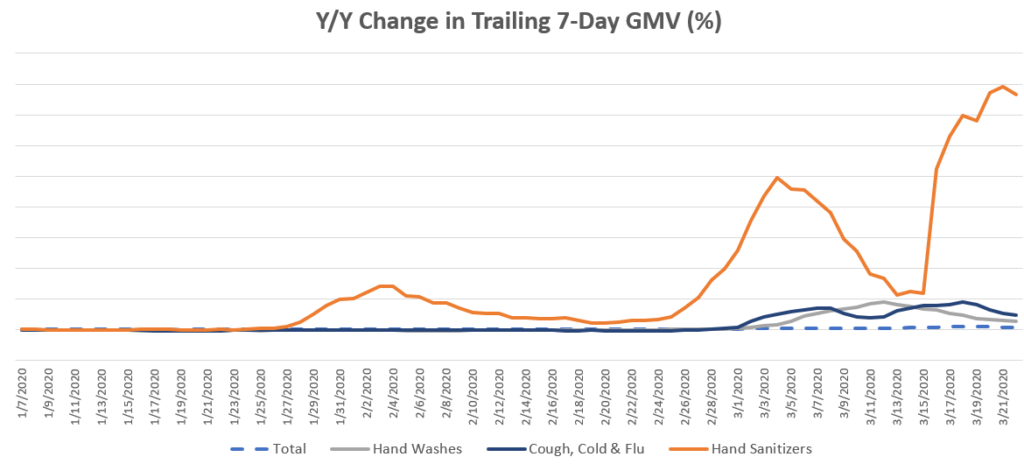

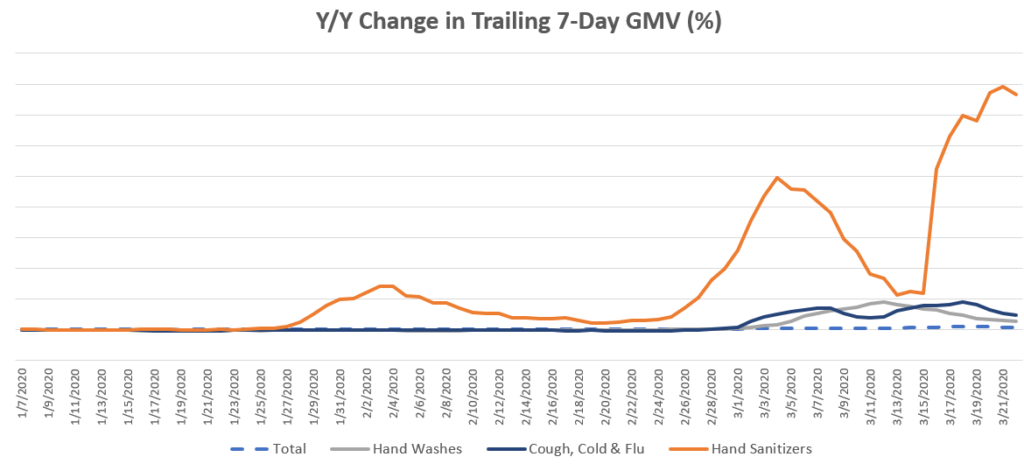

Hand sanitiser still seemed to be a hot commodity with continued significant year-over-year growth.

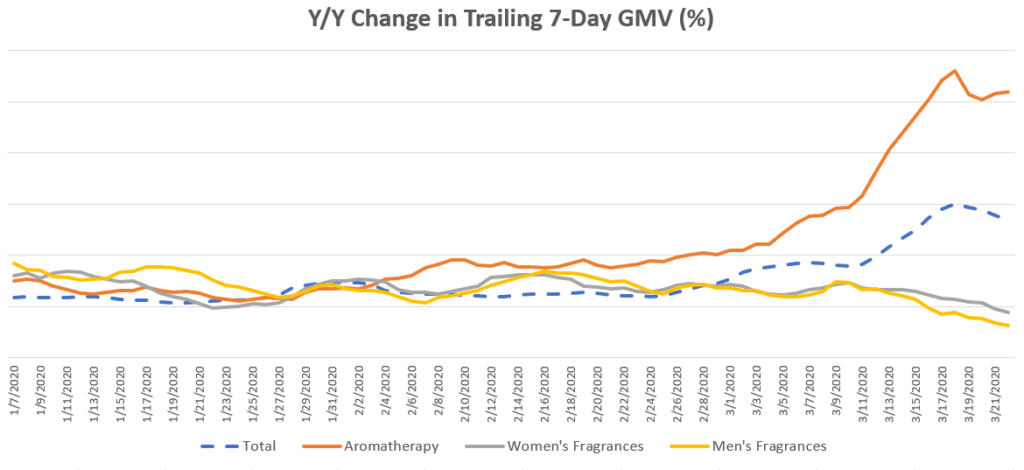

Finally, fragrances caught our attention this week. Aromatherapy grew much faster than the overall Health and Beauty category while “men’s fragrances” and “women’s fragrances” appeared to be seen as more discretionary items, at least at this juncture.

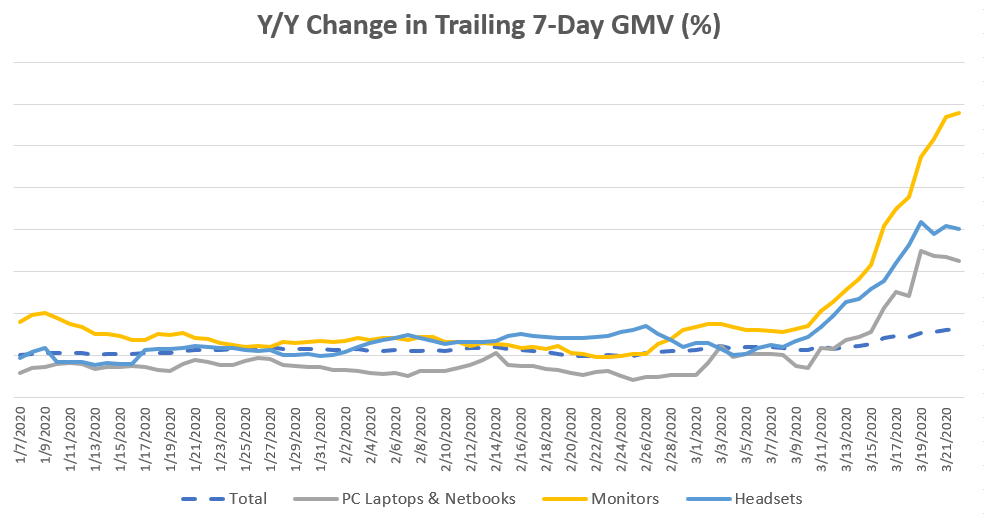

Computers, Tablets, and Networking

Last week, we noted growth in this category led by the subcategories of monitors, laptops, notebooks, and headsets and hypothesised that this was due to the increasing number of businesses that were encouraging employees to work from home. For this week, more and more governments were mandating work-from-home policies for non-essential businesses. Thus, we continued to see strong growth in these subcategories.

Home and Garden

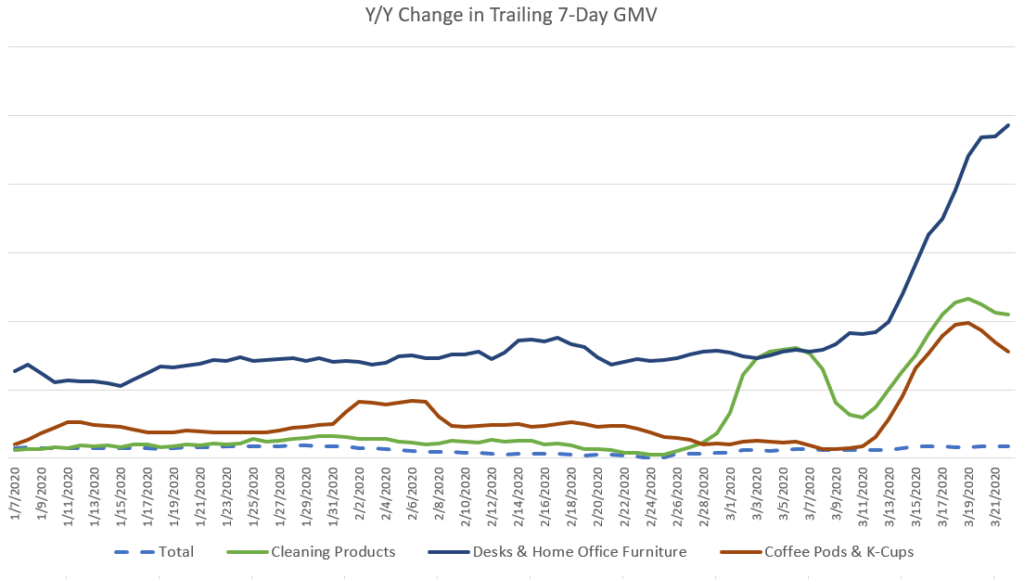

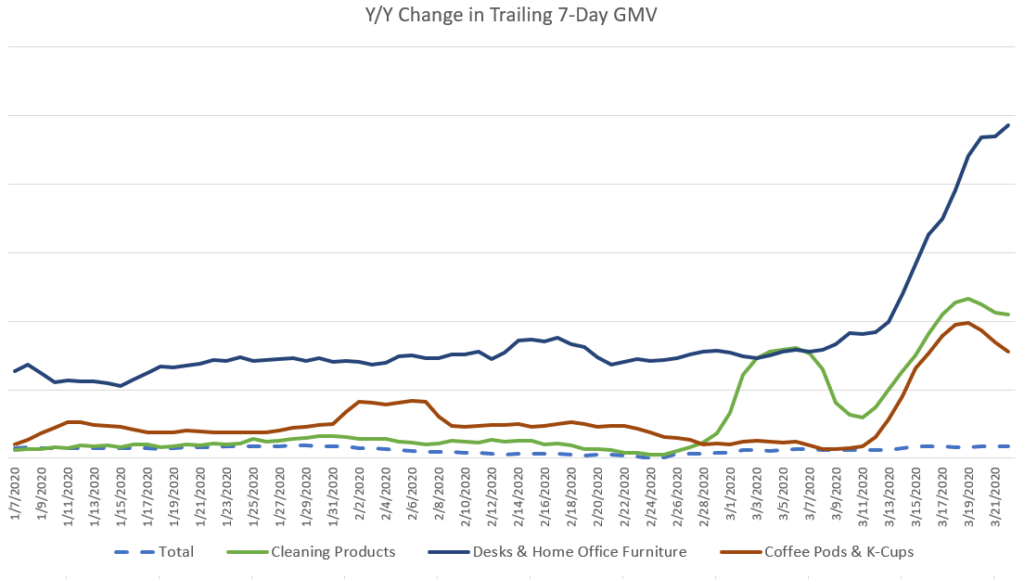

Like in last week’s post, we didn’t include Home and Garden in the top-level categories highlighted above. As a reminder, the category has had relatively steady year-over-year growth with some puts and takes over the course of 2020 to date. Looking deeper into the subcategories (of which there are more than 1,000), you see the influence of recent events.

Though the year-over-year growth rates have dipped a little compared to the previous week, consumers were still rapidly purchasing cleaning products, as well as coffee pods for work-at-home. The growth in desks and office furniture continued to increase as consumers adapt their homes to create suitable work environments.

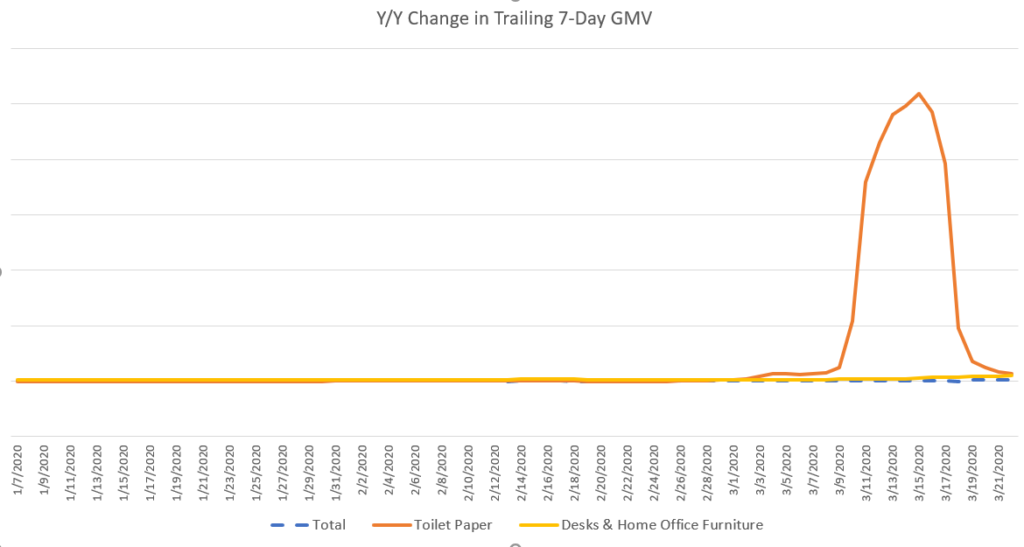

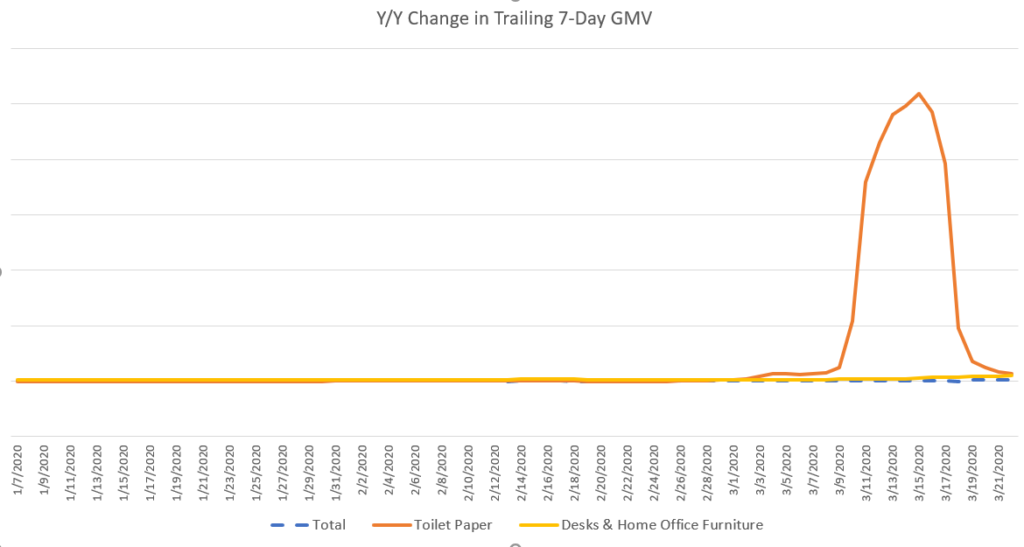

Last week we also showed the phenomenal growth in the subcategories of “toilet paper” and “bidets and toilet attachments.” To be clear, these are smaller subcategories than those listed above. However, they experienced significant growth in online marketplace sales earlier in March due to toilet paper supply issues. As expected, growth in these subcategories has decelerated substantially. You may be tempted to think that the “toilet paper” subcategory is no longer growing from the next chart. However, we have layered in the fast-growing “desks and home office furniture” subcategory to illustrate that toilet paper was still in relatively high demand.

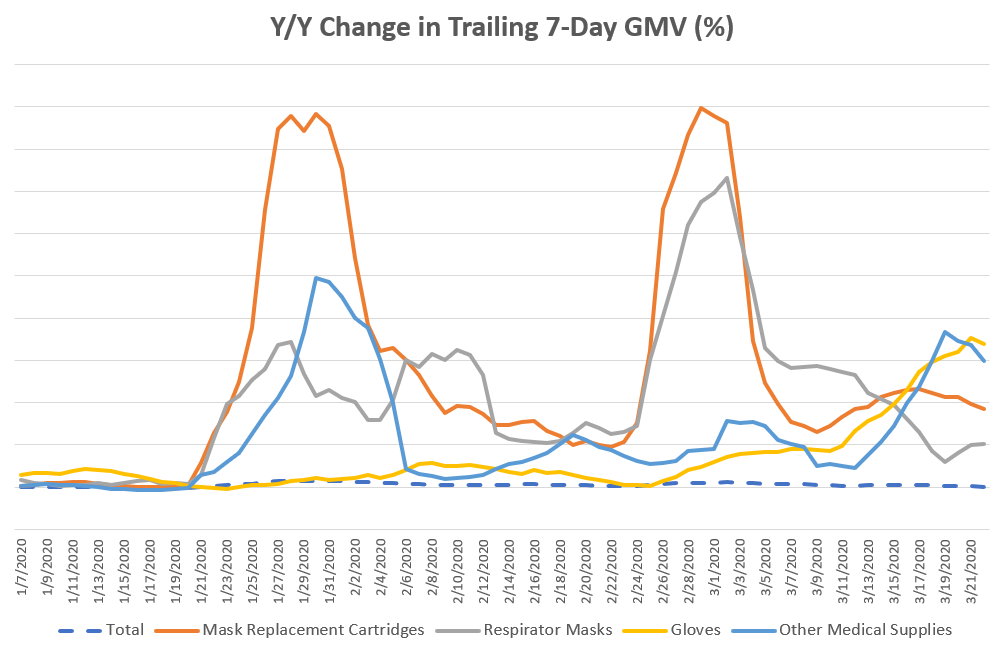

Business and Industrial

The subcategories we highlighted last week were still growing this week. The subcategories “gloves” and “other medical supplies” grew faster than “respirator masks” and “mask replacement cartridges.”

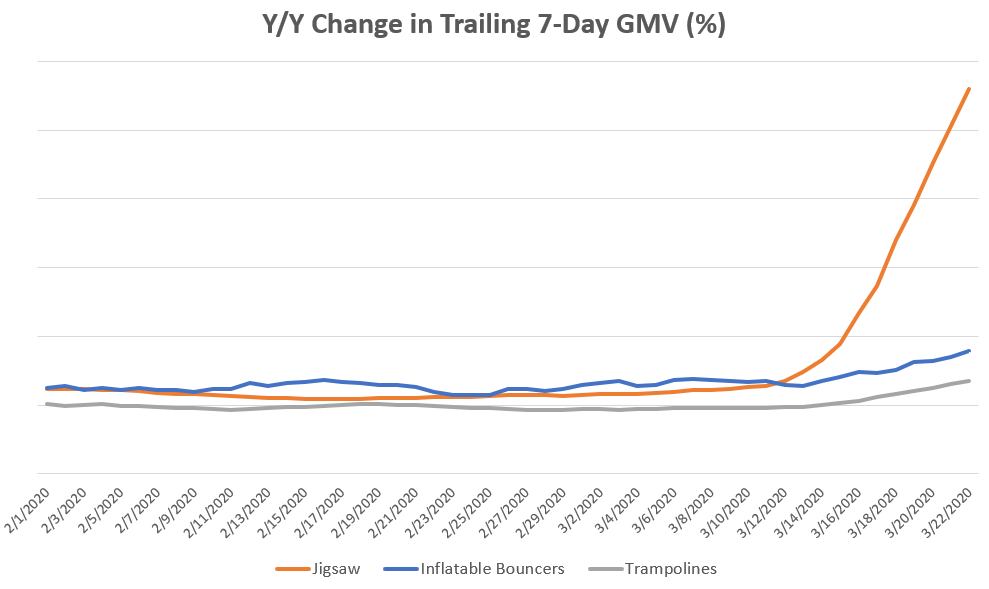

Toys and Hobbies

One interesting trend that we have added this week is a very recent uptick in certain subcategories under the Toys and Hobbies category. In the last two weeks, as schools have emptied and nearly everyone is at home, there has been a significant uptick in the “jigsaw puzzle” subcategory and smaller increases in the “inflatable bouncers” and “trampoline” subcategories.

Conclusion

This week, we’ve seen the continuation of the major trends noted last week. Consumers are focused on necessities related to the pandemic and discretionary spending has slowed considerably. However, we see potential signs of the bottom being reached in some of the hardest-hit categories and a deceleration (though still high growth) for certain subcategories that experienced the most significant growth earlier in March. Things are changing rapidly, though, so we will continue to keep an eye on marketplace GMV.

In closing, we would like to reiterate from our blog last week that the COVID-19 pandemic has created extreme turmoil globally. The impact on supply and demand and the way people work is in the news daily and can be seen in the data above. The impact seems trivial relative to the personal toll. Nevertheless, the job of ensuring that food, medicine, and other essentials make their way to people globally is important to keep society functioning as normally as possible while we work our way through the current pandemic. So, in addition to thanking medical professionals, researchers, and others for their heroic efforts in treating the sick and trying to find a cure, we’d like to thank those of you in the factories, in the grocery stores, in the distribution centers, and in the delivery trucks helping to bring us the items we need to live.